Details for the Land Transfer Duty (or Stamp Duty) waiver announced at the State Budget has been released, and the Victorian Government has given all purchasers an early Christmas present by providing a Stamp Duty waiver of up to 50% for ALL purchases in Victoria!

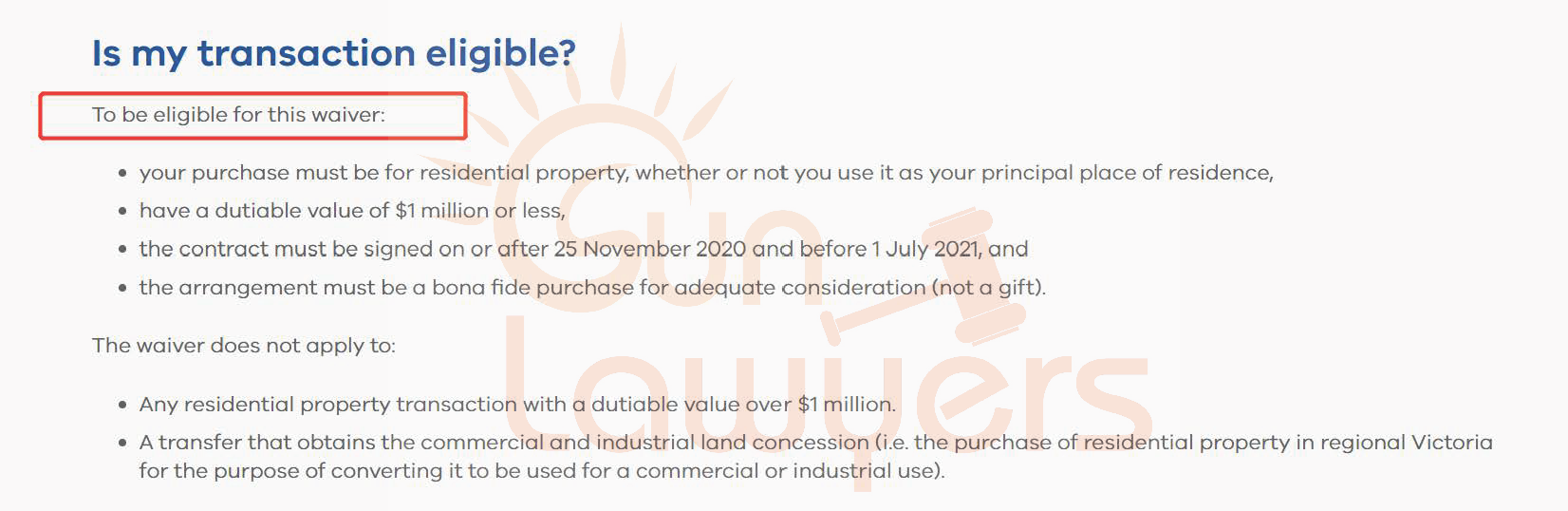

This means that there are no limits to where the property is situated, and any residential property valued up to $1 MILLION signed in the period of 25 November and 30 June 2021 can receive the following waivers:

- New residential properties – 50% waiver

- Existing residential properties and Vacant Residential Land – 25% waiver

Additional benefits

There are additional benefits that will sets this waiver apart from other concessions in Victoria:

- The waiver can be used in conjunction with all other concessions in Victoria, such as the first home buyer duty concession, principal place of residence concession, off-the-plan concession, and pensioner concession, which can all be combined with the waiver.

- Unlike other concessions such as the Homebuilder Grant or First Home Owner Grant, the waiver is not limited to one property and can be used for multiple purchases.

- The property does not need to be your principal place of residence and may be an investment property.

- Settlement does not need to be within the signing period, therefore off-the-plan apartments can also enjoy the Stamp Duty waiver. The eligibility is based on dutiable value and the property value can be much higher.

Foreign Purchasers? YES!

An additional good news is that the waiver is not limited to local purchasers and will also apply to foreign purchasers. In all the recent Covid-19 government support provided, this is the first scheme that benefits foreign purchasers, and more states may follow in their footsteps to open their benefits to foreign purchasers.

However, the waiver does not reduce the amount of surcharge duty required to be paid by foreign purchasers.

As a summary, we have created the following table for your ease of reference:

| Type of property | New Residence | Existing Residence | Vacant Land |

| Stamp Duty Waiver | 50% | 25% | 25% |

| Property Threshold | Below $1 Million in dutiable value | ||

| Contract Signing Period | Between 25 November 2020 and 30 June 2021 | ||

| Eligible purchasers | Both Foreign and Local Purchasers | ||

As the lockdown has not been lifted, many Victorians may spend the holiday period looking for new properties to make use of this rare opportunity to obtain savings on property purchases that will not be available at any other time. For more information on how to make use of the current concessions, or the application process, please do not hesitate to contact us at 02 9267 4988 or Vincent.hui@sunlaws.com at any time.

中文

中文