Blog

This is the latest announcement for the Homebuilder Grant – Construction deadline is now extended!

In a surprise announcement made after the Homebuilder Grant application deadline, the Australian Government has announced an amendment to the Grant that is greatly beneficial to all parties involved.

The Homebuilder Grant has been hugely successful in the revitalisation of the property market during the pandemic by incentivising Australians to purchase, build or renovate their property. The amendment extends the deadline for construction to commence from 6 months to 18 months after the initial contract has been signed, which creates wide reaching benefits for all Australians such as:

Relieving pressure on builders

Applicants are worrying that the builders will not be able to commence construction within 6 months of the contract date according to the grant requirements. The huge influx of demand for builders added to global supply shortages due to the pandemic meant many builders faced difficulty obtaining the necessary materials and manpower to commence construction within the short time frame. Additionally, local councils were receiving much more development applications and required more time than usual for assessment and approvals.

The extension’s purpose was to ensure that existing applicants will not be denied the Grant due to circumstances outside their control according to Treasurer Josh Frydenburg. Builders now have ample time to obtain approvals and resources to confidently meet the current demand, while Applicants no longer need to worry about the construction deadline. Having an extra year to commence construction also ensures that builders will not use cheaper substitute material or cut corners to rush to begin construction. Builders can source proper materials to build giving Purchasers will have a peace of mind regarding the quality and safety of their houses.

Sustaining long-term economic activity

With the extension of the deadline, the Australian Government is also trying to maintain long-term economic growth rather than just a short burst of activity. Builders can organise the construction of their current projects around the extended 18 months and allocate their demand for resources over the period. This spreads out the growth of the building sector, creating more business activity and employment over the extended period.

Unfortunately, this extension DOES NOT extend the application deadline of 14 April 2021. Upon enquiry to the Revenue NSW, they have confirmed that no new applications will be accepted, and the extension only applies to existing applicants.

Conclusion

The Australian Government has succeeded in their goals of stimulating the building industry with the overwhelming success of the Homebuilder Grant and the amendments further relieves existing concerns regarding the building deadline. We hope to see further governmental grants and schemes to promote the economy, and please keep an eye on our articles to stay updated on any new advances. Do not hesitate to contact us at 02 9267 4988 or Vincent.hui@sunlaws.com at any time if we can assist you in any way.

(中文) 15日开始实施!家暴行为零容忍,有过家暴行为但未定罪?仍然可能被拒签或失去签证!

Sorry, this entry is only available in 中文.

(中文) 在澳洲,生意买卖过程中常见法律问题5问5答!文末还有惊喜活动!

Sorry, this entry is only available in 中文.

MAJOR FIRB CHANGES BEGINNING 2021!SUPPORTING FOREIGN INVESTMENTS INTO AUSTRALIA

In response to the Covid-19 Pandemic, the Australian Government has imposed increased requirements on Foreign investments into Australia on 21 or 29 March 2020. However, new unexpected changes to the Foreign Investments Review Board were implemented beginning 1 January 2021 which lifted the previous restrictions, reverting to pre-covid situations and more.

These changes will make it easier for foreign investors to invest in Australia, and we have summarised the important aspects of the changes below:

In 2020, the Australian government temporarily reduced notification thresholds for commercial acquisitions to $0 due to Covid-19. All foreign investments and purchases will be required to obtain FIRB approval, creating lengthy delays with approval timeframes extended up to 6 months. In the unstable economy, the government intended to provide appropriate oversight over all proposed foreign investments to protect and support Australian businesses and Australian jobs.

Starting 1 January 2021, the notification thresholds for commercial acquisitions prior to the Covid-19 amendments have been reinstated and investors NO LONGER need to obtain approvals for commercial acquisitions below the notification threshold. This benefits foreign small business owners and commercial property investors, who will not need to obtain FIRB approval prior to their investments which, saving valuable time and costs.

This shows that the Government wants to increase the amount of foreign investments into Australia and are optimistic that Australia is still an attractive investment destination. Having more investments into Australia will help boost the economy after the pandemic and create more jobs for the local community while injecting more money back into the economy.

Under the new changes, the FIRB also has increased powers regarding National Interests. A mandatory FIRB approval will be needed if the acquisition involves a notifiable national security action, and the FIRB are also able to impose new conditions or vary present conditions even after FIRB approval in certain situations.

Conclusion

With the announcement of Covid vaccinations being available to Australians soon, the country is on its way to recovery from the pandemic. Through the recent changes to the FIRB approvals, the Government is encouraging more foreign investments to kick-start the economy’s growth.

This is a good time for Foreign Investors to take advantage of the reinstated thresholds to invest in Australian land and businesses efficiently and effectively. However, Investors will also need to be aware if their acquisitions are related to national security, as these investments may be imposed with further requirements. Despite the current unpredictable pandemic situation, Foreign Investors can remain positive that the Australian Government will continue to welcome foreign investments and may even introduce further measures to stimulate further investment activities.

If you have any queries regarding FIRB approvals, please do not hesitate to contact us at any time at 02 9267 4988 or Vincent.hui@sunlaws.com.

DETAILS OF VICTORIA’S NEW LAND TRANSFER DUTY WAIVER UP TO 50% RELEASED! Foreign Purchasers? YES!

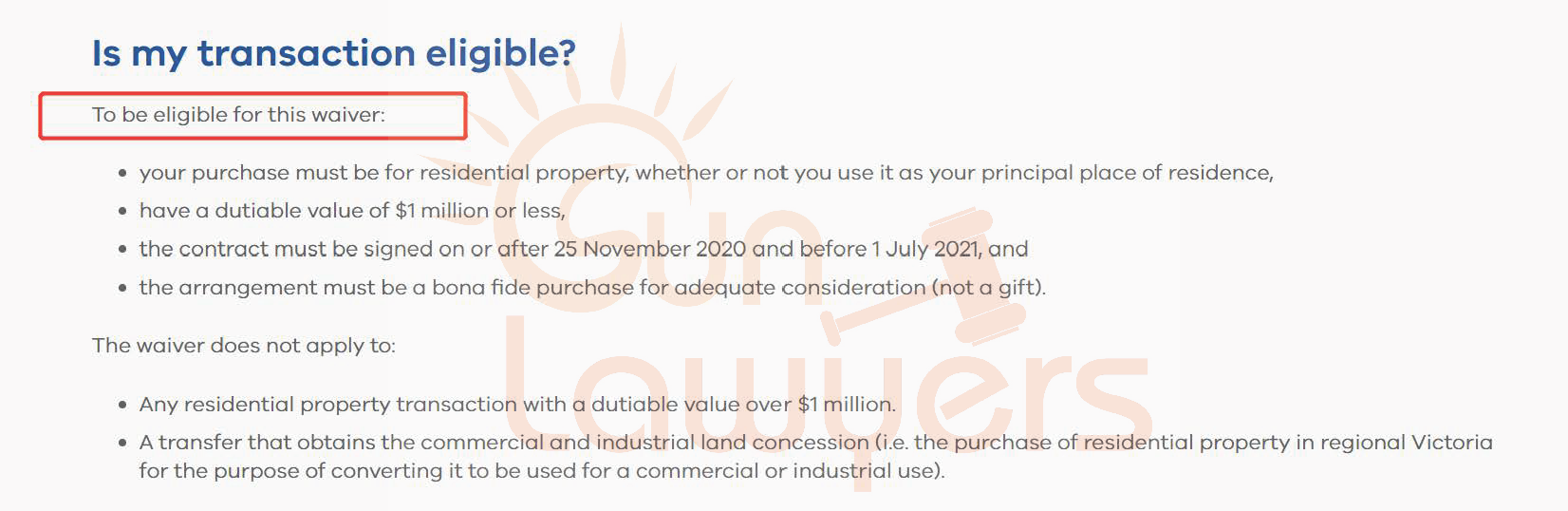

Details for the Land Transfer Duty (or Stamp Duty) waiver announced at the State Budget has been released, and the Victorian Government has given all purchasers an early Christmas present by providing a Stamp Duty waiver of up to 50% for ALL purchases in Victoria!

This means that there are no limits to where the property is situated, and any residential property valued up to $1 MILLION signed in the period of 25 November and 30 June 2021 can receive the following waivers:

- New residential properties – 50% waiver

- Existing residential properties and Vacant Residential Land – 25% waiver

Additional benefits

There are additional benefits that will sets this waiver apart from other concessions in Victoria:

- The waiver can be used in conjunction with all other concessions in Victoria, such as the first home buyer duty concession, principal place of residence concession, off-the-plan concession, and pensioner concession, which can all be combined with the waiver.

- Unlike other concessions such as the Homebuilder Grant or First Home Owner Grant, the waiver is not limited to one property and can be used for multiple purchases.

- The property does not need to be your principal place of residence and may be an investment property.

- Settlement does not need to be within the signing period, therefore off-the-plan apartments can also enjoy the Stamp Duty waiver. The eligibility is based on dutiable value and the property value can be much higher.

Foreign Purchasers? YES!

An additional good news is that the waiver is not limited to local purchasers and will also apply to foreign purchasers. In all the recent Covid-19 government support provided, this is the first scheme that benefits foreign purchasers, and more states may follow in their footsteps to open their benefits to foreign purchasers.

However, the waiver does not reduce the amount of surcharge duty required to be paid by foreign purchasers.

As a summary, we have created the following table for your ease of reference:

| Type of property | New Residence | Existing Residence | Vacant Land |

| Stamp Duty Waiver | 50% | 25% | 25% |

| Property Threshold | Below $1 Million in dutiable value | ||

| Contract Signing Period | Between 25 November 2020 and 30 June 2021 | ||

| Eligible purchasers | Both Foreign and Local Purchasers | ||

As the lockdown has not been lifted, many Victorians may spend the holiday period looking for new properties to make use of this rare opportunity to obtain savings on property purchases that will not be available at any other time. For more information on how to make use of the current concessions, or the application process, please do not hesitate to contact us at 02 9267 4988 or Vincent.hui@sunlaws.com at any time.

HOMEBUILDER SCHEME UPDATE – EXTENDED DATES AND INCREASED AVAILABILITY!

On the 29th of November 2020 the Australian Government announced an update to the Homebuilder Scheme in order to further stimulate the property market, aiming to create jobs and boost economic activity.

As a refresher, the Homebuilder Scheme provides a monetary grant to applicants who have carried out the eligible works of either renovating existing property or building new property.

The personal criteria for the applicant remain unchanged, and you must fulfil the following:

- Be an Australian Citizen aged 18 and above;

- If applying as an individual, annual income must not exceed $125,000; and

- If applying as a couple, combined annual income must not exceed $200,000.

However, the Government has introduced many changes benefiting Australians looking to take advantage of the Homebuilder scheme.

Grant Period Extension

Previously, contracts must be signed between 04 June and 31 December 2020 to qualify for the Homebuilder Scheme (the Initial Scheme). This deadline has been extended to include contracts signed between 1 January and 31 March 2021 (the Extended Scheme). While the grant amount for the Extended Scheme has been reduced to $15,000, it still provides a good opportunity for people looking to build or renovate to obtain the grant if they missed out on the initial deadline.

Application Deadline

The Application Deadline has also been extended from 31 December 2020 to 14 April 2021. Both applicants for the Initial Scheme and the Extended Scheme now have extra time to prepare their applications.

Increased Price cap

Under the Initial Scheme, the property value for new builds were capped at $750,000. This cap has been increased to $950,000 in NSW and $850,000 in Victoria for the extended Scheme. The higher cap works hand in hand with the increased threshold of the First Home Buyer Assistance Scheme to help first home buyers afford their first property. Secondly, the increased cap covers off the plan apartments as well as land and build contracts of better locations and bigger sizes, enticing more potential buyers to take advantage of the Scheme.

A detailed summary of both the Initial and Extended Scheme can be found in the table below provided by the Treasury.

If you have any questions regarding your eligibility or the application process, please do not hesitate to contact us at Vincent.hui@sunlaws.com or 02 9267 4988.

(中文) 澳洲境外申请人不能再申请一步到位拿永居的GTI签证了?当然不是!

Sorry, this entry is only available in 中文.

(中文) 关于本财年火热的一步到位移民GTI 签证,大家关注的点有哪些?!

Sorry, this entry is only available in 中文.

中文

中文